Spring 2021 news update!

Covid-19

ROAD MAP OUT OF LOCKDOWN

Step 1 – 8th March – Schools and colleges resume. People can meet one other person outside for recreation. Care homes allowed one regular named visitor. Stay at Home order remains in place.

Step 1 – 29th March – Outdoor gatherings of up to 6 people or two households allowed, including in private gardens. Outdoor sports facilities to re-open. Stay at home order ends –but people encouraged to stay local. Work from home wherever possible. No Overseas travel.

Step 2 – 12th April –Non-essential retail opens. Outdoor hospitality in pubs and restaurants allowed with households or rule-of-six. Most outdoor settings re-open such as zoos and theme parks. Gyms and indoor pools open. Self-catering holiday accommodation and campsites re-open. Funerals – up to 30 people, Weddings – up to 15 people.

Step 3 – 17th May –Most social contact rules lifting as well as some mixing indoors.

Stage 4 – 21st June – Life to return, all legal limits and social contacts to be lifted.

From the budget:

Furlough scheme extended until end of September with phased reduction

The 80% subsidy will remain for now, but, from July, employers will be asked to contribute 10% of this, and then 20% in August and September.

SEISS – Self-Employment Income Support Scheme

Now covers those who entered self-employment in 2019/20 tax year provided they had filed a tax return for that period by 2nd March 2021.

SEISS fourth grant to cover to 30th April and a fifth then covering the 5 months to 30th September as long as the conditions are met to show that turnover has dropped.

Personal Allowance and Higher Rate Threshold- increased and then frozen

Personal Allowance will rise to £12,570 from April 2021 – and is then frozen until April 2026

Higher rate threshold will rise to £50,270 – and is also then frozen until April 2026

Business rates holiday

Will be extended in England for a further 3 months from April 2021

VAT reduction in the Hospitality and Tourism Sectors

The current VAT reduction from 20% to 5% will be extended beyond 31st March cut-off until 30th September. From 1st October until 31st March 2022 a special rate of 12.5% will apply

The Community Ownership Fund – help for community groups to buy or take over local community assets at risk of being lost.

Community groups can bid for up to £250,000 matched funding to help them buy endangered sports clubs, theatres, music venues and Post office buildings that have been hard hit by the pandemic.

Restart grants

Non-essential retail businesses can claim up to £6000. Businesses who have been locked down for longer ie, hospitality, accommodation, leisure, personal care and gyms, will be eligible for up to £18,000 per premise.

Recovery Loan Scheme

Ensures business of any size can continue to access loans and other finance up to £10m with 80% government guarantee

New scheme that replaces the Bounceback loan scheme and the Coronavirus Business Interruption Loan Scheme (CBILS)

Help to grow: Management and Digital

Two schemes aimed at boosting productivity, growth and innovation in UK SME’s over the next three years.

- Help to Grow: Management will provide management training and mentoring in a 12week course with 90% subsidy.

- Help to Grow: Digital will provide help with increasing productivity through digital transformation.

For more information and to register for both programmes, visit gov.uk/helptogrow.

IR35 – off- payroll working rules in the private sector – changes from 6th April

VAT deferral scheme

Helps businesses with deferred VAT to pay what they owe in smaller monthly instalments from March, interest-free. You can choose to make between 2 and 11 monthly payments depending on when you join. The later you join the fewer instalments will be available.

This must be completed by the VAT-registered person on their login page through his or her own Government Gateway and NOT by their accountant

Find out how to pay VAT payments deferred between 20 March and 30 June 2020. You can pay now or join the VAT deferral new payment scheme.

(https://www.gov.uk/government/organisations/hm-revenue-customs)

The month you decide to join the scheme will determine the maximum number of instalments that are available to you. If you join the scheme in March, you’ll be able to pay your deferred VAT in 11 instalments or fewer.

If you want to join the new payment scheme, but cannot use the online service, contact the COVID-19 helpline on Telephone: 0800 024 1222. An adviser will help you join.

5% late payment penalties – For 2019/20, HMRC are delaying the imposition of this penalty and are giving taxpayers until midnight on 1 April 2021 to either pay their 2019/20 tax bill or agree a time to pay arrangement.

VAT Reverse Charge for Construction Services

The VAT domestic reverse charge for construction services started on 1 March 2021. It’s a major change to the way VAT is collected in the construction industry

It will affect you if both the supplier and recipient of Construction Industry Services are VAT registered. Please contact me if you think you may be affected.

2020/21 Tax Year Returns

You will shortly receive a tax return or notice to file a tax return for the year ended 5 April 2021. I will write to you under separate cover with the 2021 Tax Information Questionnaire.

Need help or advice? Get in touch on 01273 474885 or 07973 410780

Or come and visit us. At our offices by the sea! You can find us at Brighton Marina. With FREE PARKING!!

Our address is:

JDA Tax & Accountancy Services Ltd

Suites 2 & 3 Marine Trade Centre,Lockside

Brighton Marina, Brighton BN2 5HA

Come and say hello

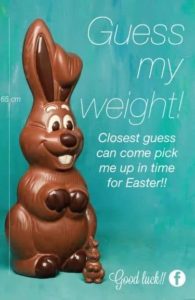

Develdas Luxury Chocolates & Gifts

Based in Brighton Marina and owned by Mrs Linda Deeprose (wife of Peter).

Based in Brighton Marina and owned by Mrs Linda Deeprose (wife of Peter).

JDA clients will be entitled to a 10% discount on Chocolates and Gifts purchased from Develdas.

Orders also online www.develdas.co.uk

JDA clients enter promotion code JDA to receive a 10% discount.

Easter bunny competition via Develdas Facebook page click here

Easter bunny competition via Develdas Facebook page click here

All the staff of JDA Tax & Accountancy Services Limited and Develdas Luxury Chocolates and Gifts wish our clients a healthy, happy, productive and optimistic start to 2021.

All the staff of JDA Tax & Accountancy Services Limited and Develdas Luxury Chocolates and Gifts wish our clients a healthy, happy, productive and optimistic start to 2021